This simple investing strategy has been a benchmark for many traders for over 50 years. This strategy aims to provide a distributed allocation between stocks and bonds. Being invested 60% in stocks and 40% in bonds is meant to give you an edge when the stock market is up by holding 60% stocks, while protecting you from the drawdowns of a tumbling market by keeping you 40% in bonds.

ETFs used for this strategy*

*At shüts we use ETFs to represent an asset class of a strategy. This enables us to backtest a strategy strength for over decades, it also provides an easier way for you to follow a strategy.

Strategy Type

This is a Steady strategy, the asset allocation does not change on a month-to-month basis.

How it works

Investors buy 60% stocks and 40% bonds. Rebalance every year to make sure the 60/40 split between stocks and bonds is maintained.

Performance

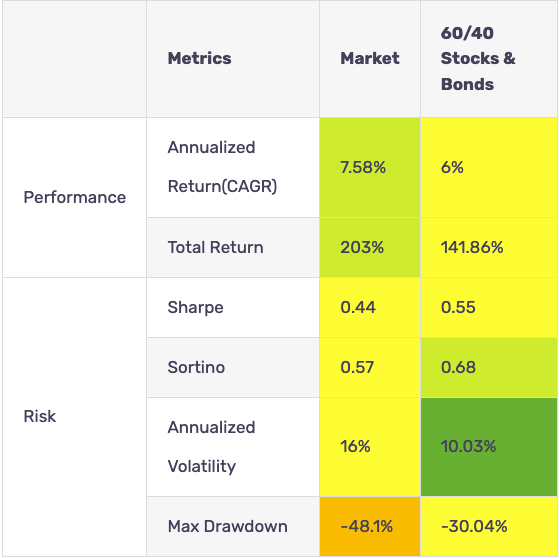

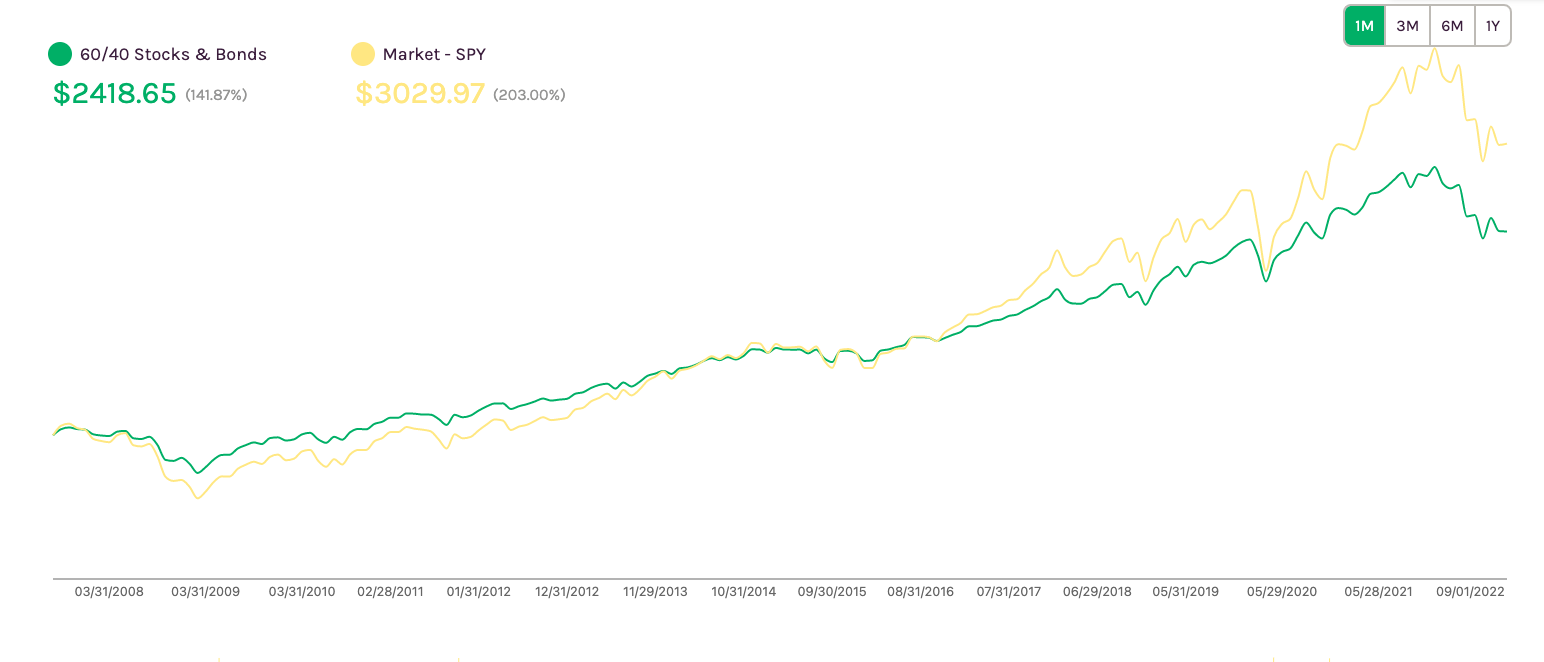

We tested this strategy running it from 09/01/2007 to 09/01/2022, last 15 years.

| Metrics | Market | 60/40 Stocks & Bonds | |

|---|---|---|---|

| Performance | Annualized Return(CAGR) | 7.58% | 6% |

| Total Return | 203% | 141.86% | |

| Risk | Sharpe | 0.44 | 0.55 |

| Sortino | 0.57 | 0.68 | |

| Annualized Volatility | 16% | 10.03% | |

| Max Drawdown | -48.1% | -30.04% |