This strategy is a simplified version of Ray Dalio’s All Weather Fund, a popular hedge fund amongst institutional investors. It aims to perform well across all environments. While the All Weather Fund does a lot of active management not available to everyday investors, this strategy aims to simplify the fund while following the same philosophy. The strategy is to diversify in below asset type:

- Total Stock Market: for growing markets

- Long-term Bonds: for falling markets

- Intermediate Bonds: for growth and inflation

- Commodities: for growth and inflation

- Gold: to protect from inflation

ETFs used by shuts

*At shüts we use ETFs to represent an asset class of a strategy. This enables us to backtest a strategy strength for over decades, it also provides an easier way for you to follow a strategy.

Strategy Type

This is a Steady strategy, the asset allocation does not change on a month-to-month basis.

How it works

This strategy can be implemented in your portfolio by below allocation splits between asset classes.

- Total Stock Market: 30%

- Longterm Bonds: 40%

- Intermediate Bonds: 15%

- Commodities: 7%

- Gold: 8%

Performance

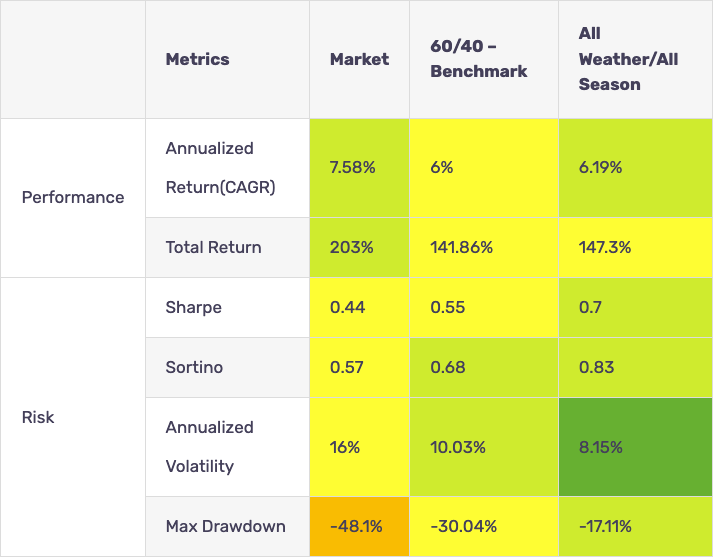

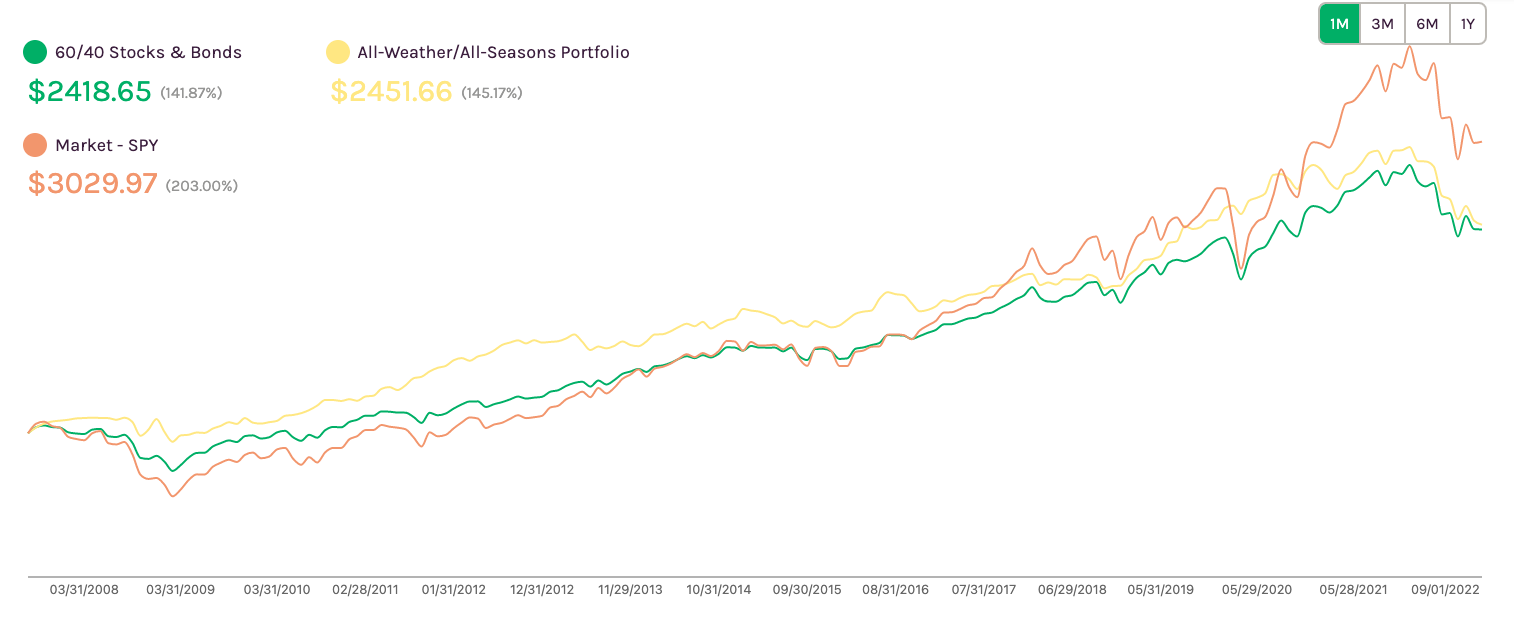

We tested this strategy running it from 09/01/2007 to 09/01/2022, last 15 years using shüts strategy backtesting.

| Metrics | Market | 60/40 – Benchmark | All Weather/All Season | |

|---|---|---|---|---|

| Performance | Annualized Return(CAGR) | 7.58% | 6% | 6.19% |

| Total Return | 203% | 141.86% | 147.3% | |

| Risk | Sharpe | 0.44 | 0.55 | 0.7 |

| Sortino | 0.57 | 0.68 | 0.83 | |

| Annualized Volatility | 16% | 10.03% | 8.15% | |

| Max Drawdown | -48.1% | -30.04% | -17.11% |