This strategy has evolved from Permanent Portfolio by Harry Browne. While it aims to reduce risk, it also adds exposure to upcoming growth market, thus giving it an edge. It distributes assets into five main allocations:

- Total Stock Market: for when there is economic expansion

- Small Cap: for upcoming growth market

- Long Term Bonds: for when there is deflation

- Short Term Bonds: for economic recession

- Gold: to protect from Inflation

ETFs used by shuts

*At shüts we use ETFs to represent an asset class of a strategy. This enables us to backtest a strategy strength for over decades, it also provides an easier way for you to follow a strategy.

Strategy Type

This is a Steady strategy, the asset allocation does not change on a month-to-month basis.

How it works

This strategy can be implemented in your portfolio by below allocation splits between asset classes.

- Total Stock Market: 20%

- Small Cap: 20%

- Long Term Bonds: 20%

- Short Term Bonds: 20%

- Gold: 8%

Performance

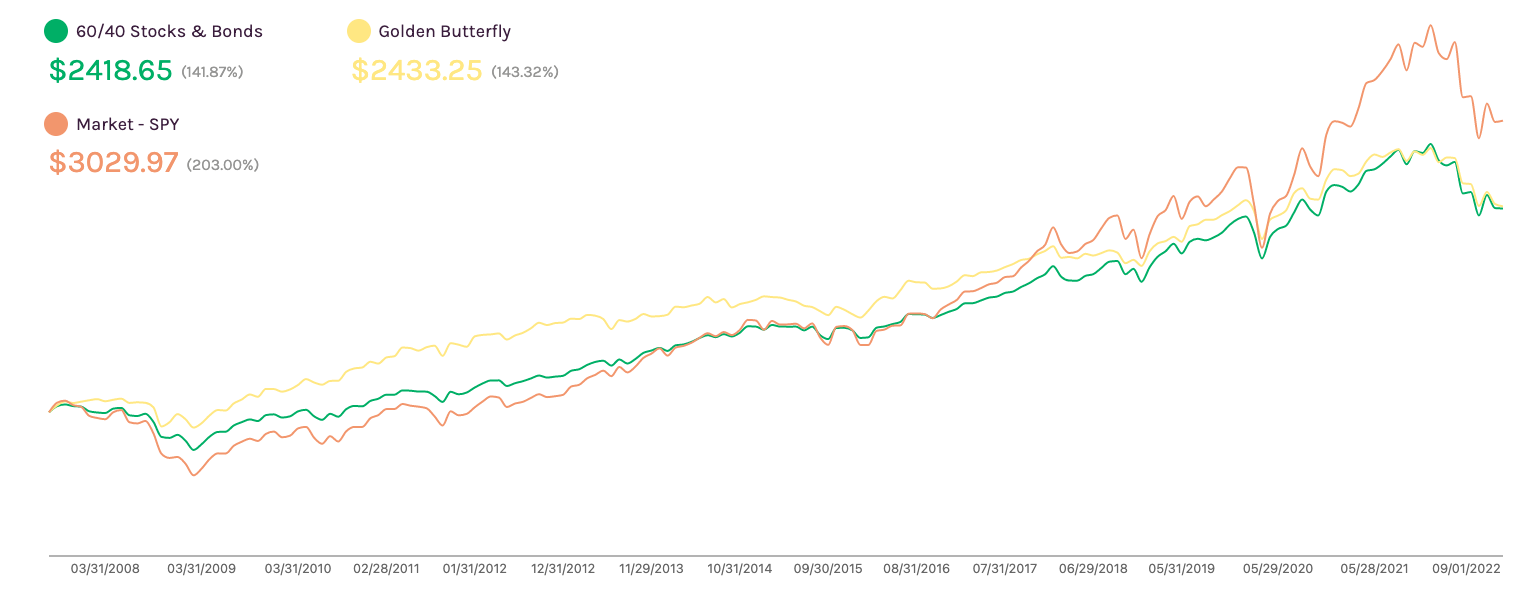

We tested this strategy running it from 09/01/2007 to 09/01/2022, last 15 years using shüts strategy backtesting.

| Metrics | Market | 60/40 – Benchmark | Golden Butterfly | |

|---|---|---|---|---|

| Performance | Annualized Return(CAGR) | 7.58% | 6% | 6.04% |

| Total Return | 203% | 141.86% | 143.32% | |

| Risk | Sharpe | 0.44 | 0.55 | 0.6 |

| Sortino | 0.57 | 0.68 | 0.74 | |

| Annualized Volatility | 16% | 10.03% | 9.17% | |

| Max Drawdown | -48.1% | -30.04% | -18.42% |