This portfolio by Harry Browne was designed to perform in all economic conditions. It splits total allocation into four types equally:

- Stocks: for when there is economic expansion

- Bonds: for when there is deflation

- Cash: for economic recession

- Gold: to protect from Inflation

ETFs used by shuts

- Stocks: SPY

- Bonds: TLT

- Cash: BIL

- Gold: GLD

*At shüts we use ETFs to represent an asset class of a strategy. This enables us to backtest a strategy strength for over decades, it also provides an easier way for you to follow a strategy.

Strategy Type

This is a Steady strategy, the asset allocation does not change on a month-to-month basis.

How it works

This strategy can be implemented in your portfolio by below allocation splits between asset classes.

- Stocks: 25%

- Bonds: 25%

- Cash: 25%

- Gold: 25%

Performance

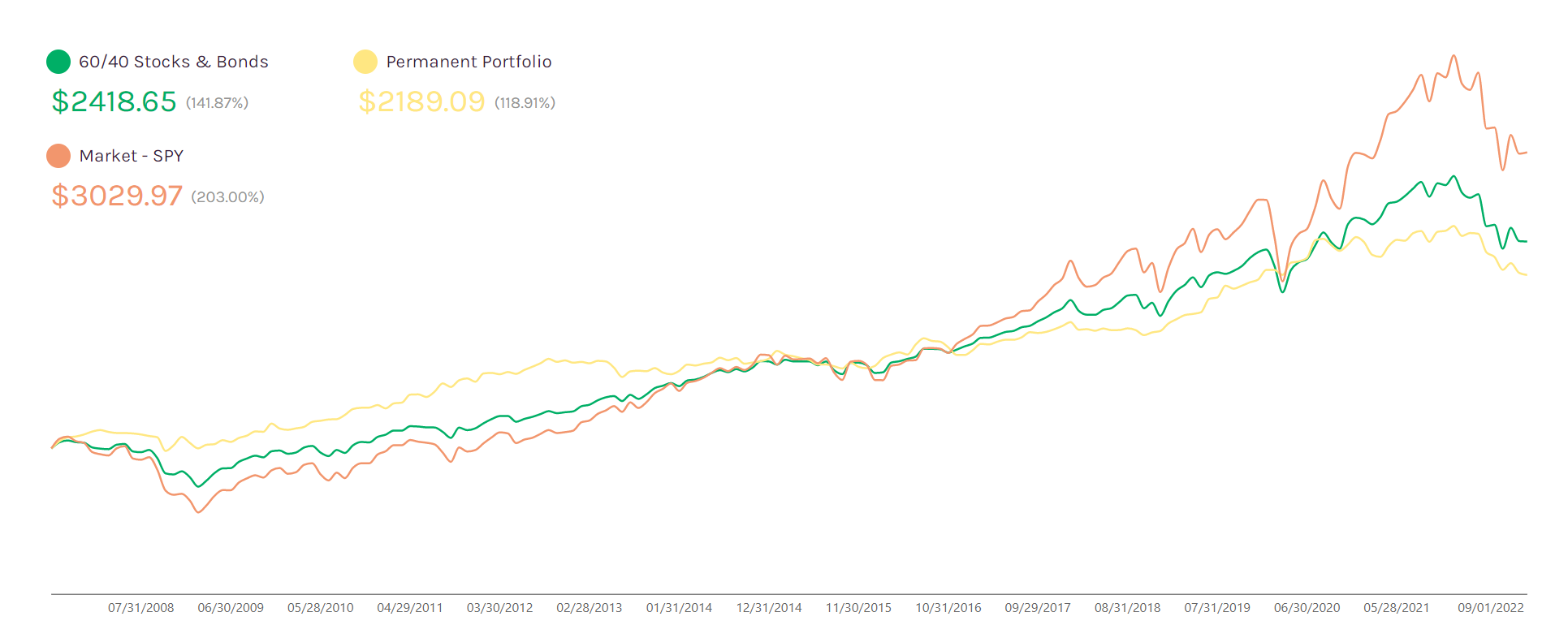

We tested this strategy running it from 09/01/2007 to 09/01/2022, last 15 years using shüts strategy backtesting.

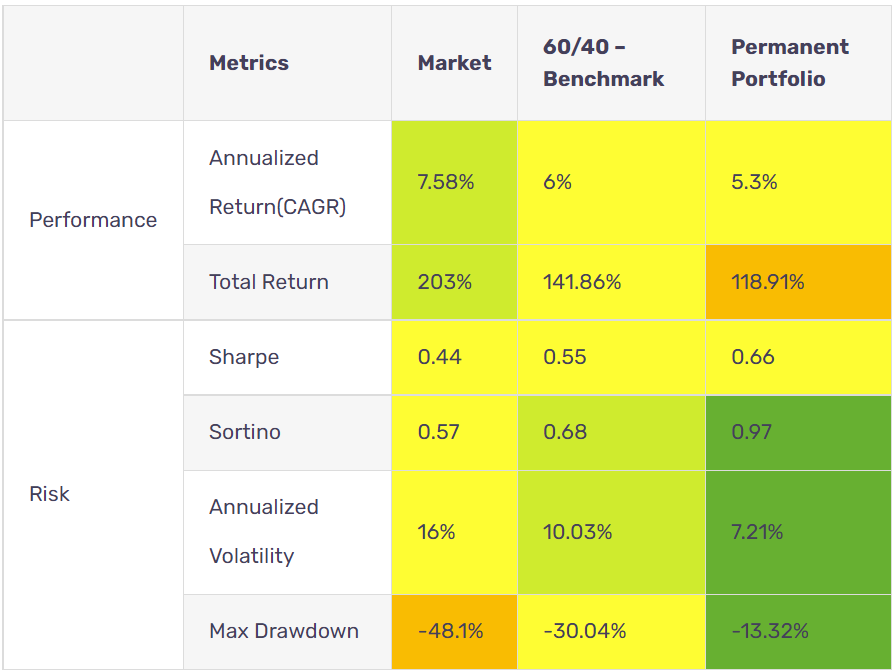

| Metrics | Market | 60/40 – Benchmark | Permanent Portfolio | |

|---|---|---|---|---|

| Performance | Annualized Return(CAGR) | 7.58% | 6% | 5.3% |

| Total Return | 203% | 141.86% | 118.91% | |

| Risk | Sharpe | 0.44 | 0.55 | 0.66 |

| Sortino | 0.57 | 0.68 | 0.97 | |

| Annualized Volatility | 16% | 10.03% | 7.21% | |

| Max Drawdown | -48.1% | -30.04% | -13.32% |