This strategy’s objective is to maximise the investor’s returns while maintaining a high level of risk control. The strategy achieves this by intelligently combining a selection of ETFs that stand out based on their momentum scores in order to achieve a consistently high return stream.

ETFs used by shuts

- Commodities: PDBC, DBC

- Major Index: QQQ, XRT, SPY, IWM, IJH, VB

- Global Index: VXUS, VSS

- Corporate Bonds: HYG, LQD

- Treasury Bonds: TIP, TLT, VGLT

- Cash: BIL

*At shüts we use ETFs to represent an asset class of a strategy. This enables us to backtest a strategy strength for over decades, it also provides an easier way for you to follow a strategy.

Strategy Type

This is an energized strategy, depending on the technical indicator the asset allocations of this strategy could change once every month.

Technical Indicators

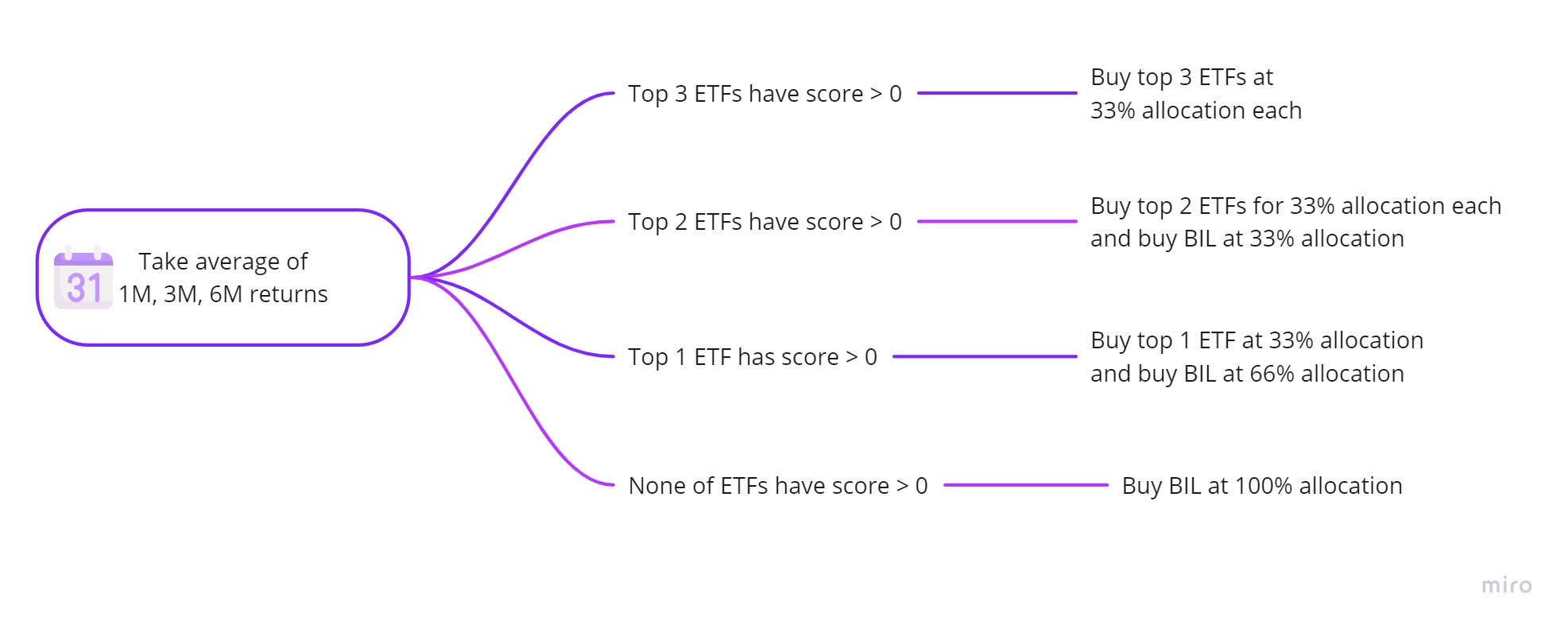

Moving Average of 1-month, 3-month, and 6-month returns.

How it works

On the last trading day of the month, calculate the momentum score (technical indicator) of the 16 ETFs listed above. Then, follow the flowchart.

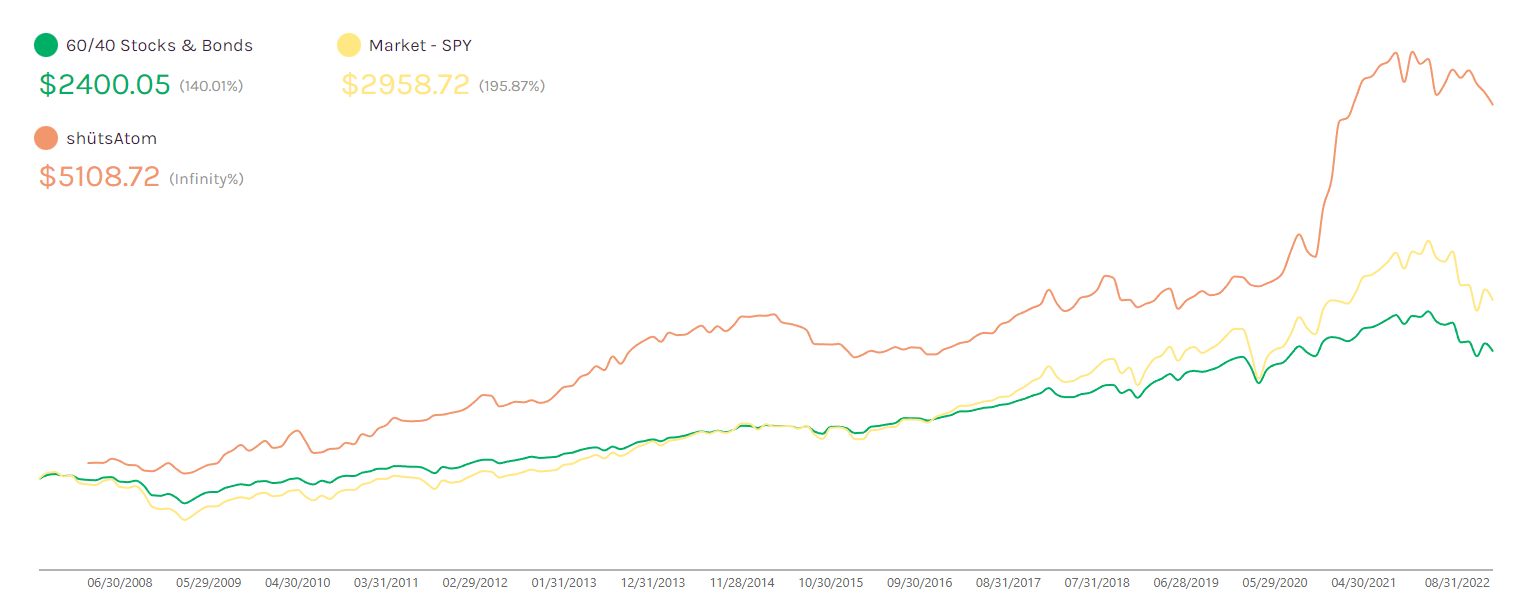

Performance

We tested this strategy running it from 09/01/2007 to 09/01/2022, last 15 years using shüts strategy backtesting.

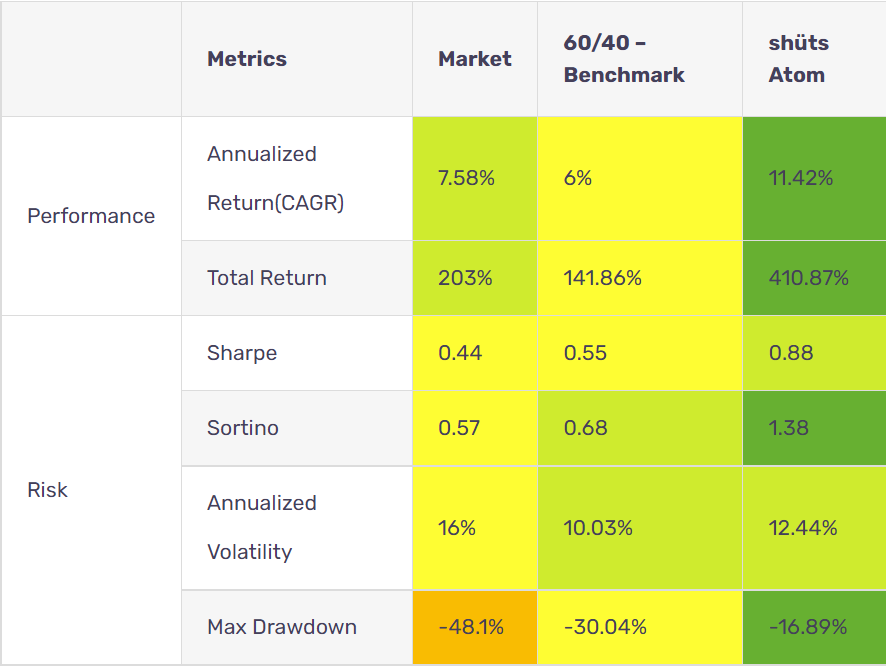

| Metrics | Market | 60/40 – Benchmark | shüts Atom | |

|---|---|---|---|---|

| Performance | Annualized Return(CAGR) | 7.58% | 6% | 11.42% |

| Total Return | 203% | 141.86% | 410.87% | |

| Risk | Sharpe | 0.44 | 0.55 | 0.88 |

| Sortino | 0.57 | 0.68 | 1.38 | |

| Annualized Volatility | 16% | 10.03% | 12.44% | |

| Max Drawdown | -48.1% | -30.04% | -16.89% |