This strategy is an evolution of Dual Momentum. ADM is created by Engineered Portfolio. It aims to provide a simple asset allocation mechanism between three main segments: US Equities, Global Small Stocks, and Treasury Bonds. These asset types are picked because of their inverse correlation to each other – when one goes down, other goes up, thus helping balance your investment.

ETFs used by shüts to follow this strategy:

*At shüts we use ETFs to represent an asset class of a strategy. This enables us to backtest a strategy strength for over decades, it also provides an easier way for you to follow a strategy.

Strategy Type

This is an energized strategy, depending on the technical indicator the asset allocations of this strategy could change once every month.

Technical Indicators

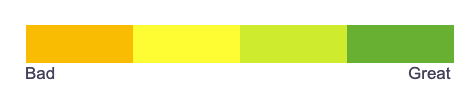

Moving Average of 1-month, 3-month, and 6-month returns.

How it works

On the last trading day of the month, calculate the momentum score (technical indicator) of the 3 asset class ETFs listed above. Then, follow the flowchart.

Performance

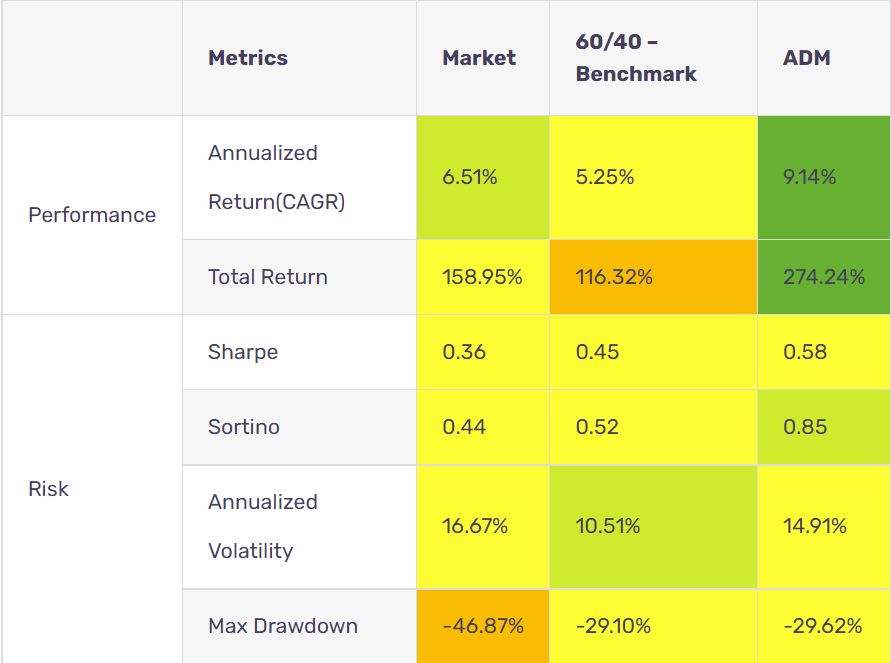

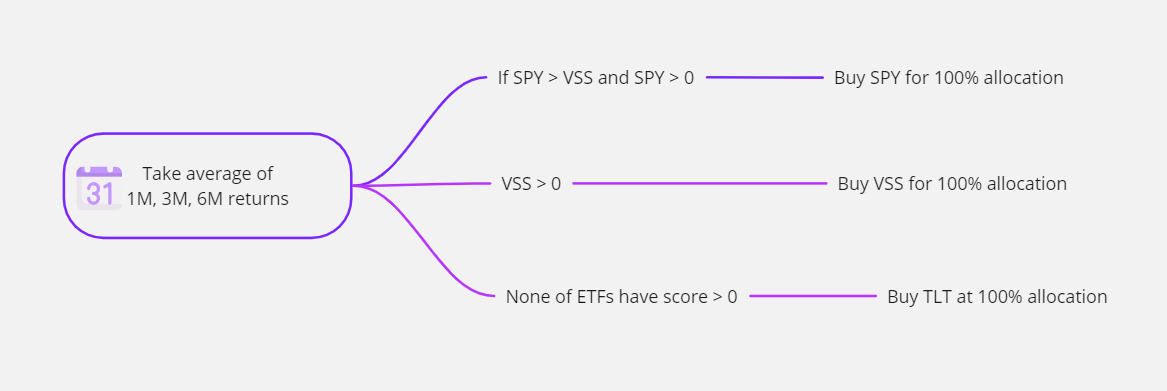

We tested this strategy running it from 10/01/2007 to 10/01/2022, last 15 years using shüts strategy backtesting.

| Metrics | Market | 60/40 – Benchmark | ADM | |

|---|---|---|---|---|

| Performance | Annualized Return(CAGR) | 6.51% | 5.25% | 9.14% |

| Total Return | 158.95% | 116.32% | 274.24% | |

| Risk | Sharpe | 0.36 | 0.45 | 0.58 |

| Sortino | 0.44 | 0.52 | 0.85 | |

| Annualized Volatility | 16.67% | 10.51% | 14.91% | |

| Max Drawdown | -46.87% | -29.10% | -29.62% |