At shüts we have a bunch of strategies that user can pick. This is both good and bad at the same time as its hard to pick one over the other, that is why we have shüts risk assessment quiz to filter it down for you. You can take the free assessment here.

Once you are done with your risk assessment you will see this section on the page that helps you with one or more strategy on the platform that matches your risk tolerance and investor behaviour.

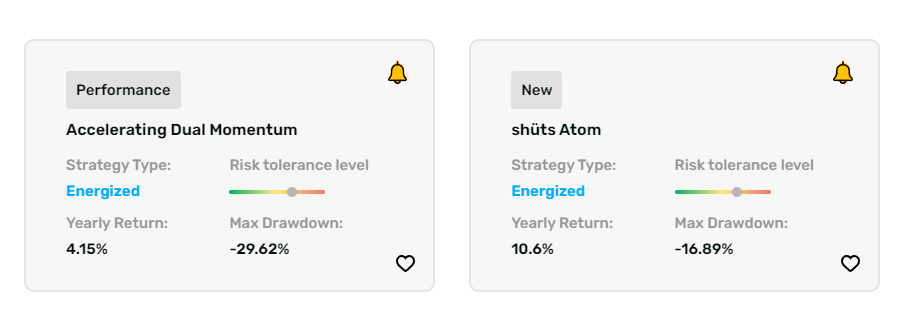

Based on the summary metrics above it seems like an easy pick for me to use shüts Atom instead of ADM. The annualized returns are higher with a lower drawdown, thus making it easy. But there is a third factor that would need to be considered access to the asset class. ADM deals with 3 asset class where as shüts Atom deals with 6 asset class. Though my regular brokerage, roth and other investment accounts have access to the 6 asset class ETFs on shuts atom, my 401k and HSA account doesn’t. But it does have access to the 3 ADM asset classes. Thus I personally use a combination of the above 2 strategies in my portfolio, keeping me rule driven!

If you have access to both the strategies asset classes in all your portfolio you can chose a strategy based on the metrics that matter to you the most or the complexity of the strategy.