Starting a job as a fresh new graduate, with the thrill of a paycheck every two weeks, is empowering and is the first step towards financial freedom. Just like most millennials, you’ve listened to the advice doled out by your folks and put a substantial chunk of your income into a savings account. Savings are good – a rainy day fund is essential. But the secret sauce to building wealth and attaining financial freedom lies in something else altogether – Investments.

The money you put into your savings account or into cash deposits is an investment. The larger sums of money put into popular online brokerages are investments too. The difference? The growth factor often associated with stocks.

Power of Compounding

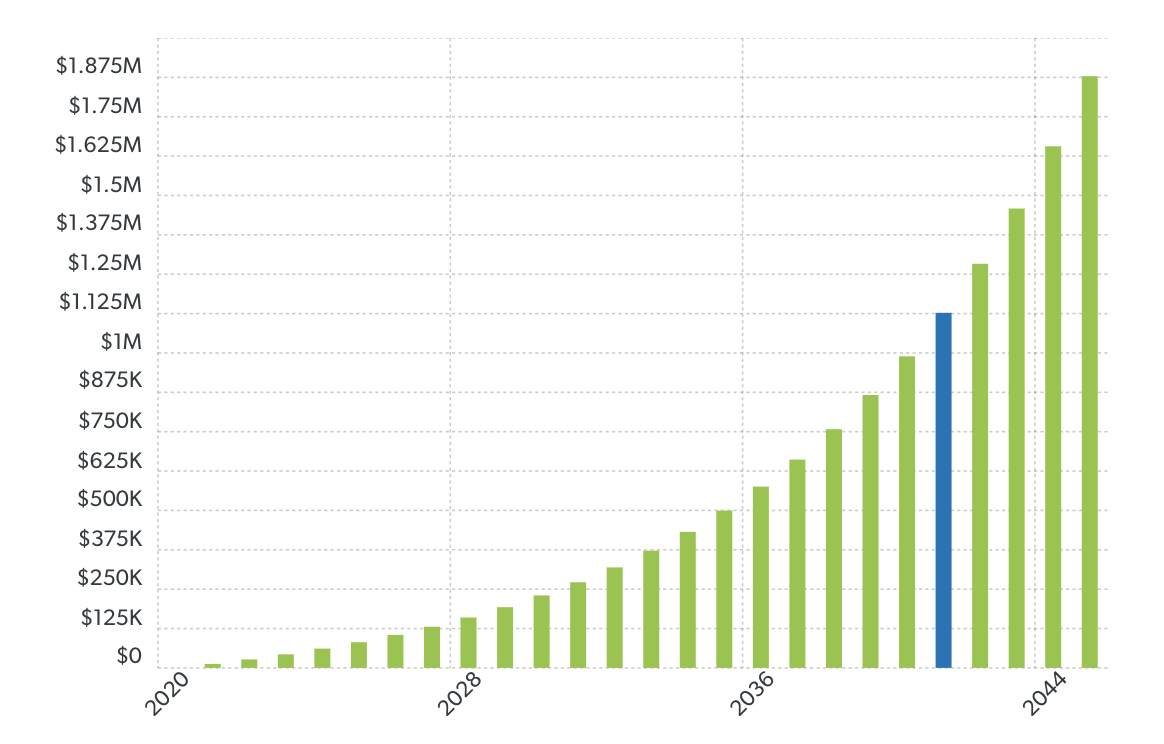

Compounding accelerates the pace at which your money grows and is a factor that is often severely overlooked and under-considered. The numbers speak for themselves. If you invested just $1,000 a month, at the end of 25 years, you would have amassed $1,878,846. Let that sink in.

What Affects Compounding

There are three factors to consider:

- Your monthly contribution

- Duration of investment

- Rate of return

Two out of three factors can usually be controlled easily. Here’s how:

- Your monthly contribution = what you can afford to invest monthly with a fair degree of consistency

- Duration of investment = long-ish time frame to give your money time to grow, but adaptable to your preferences

- Rate of return = unknown factor

The type of investment you pick affects your rate of return. Savings accounts typically offer a 2% annual rate of return. Compare this to investments in the stock market. Historically, the 30-year return on the S&P 500 – a stock market index tracking the stock performance of the 500 largest public companies in the U.S. – has been roughly 12%.

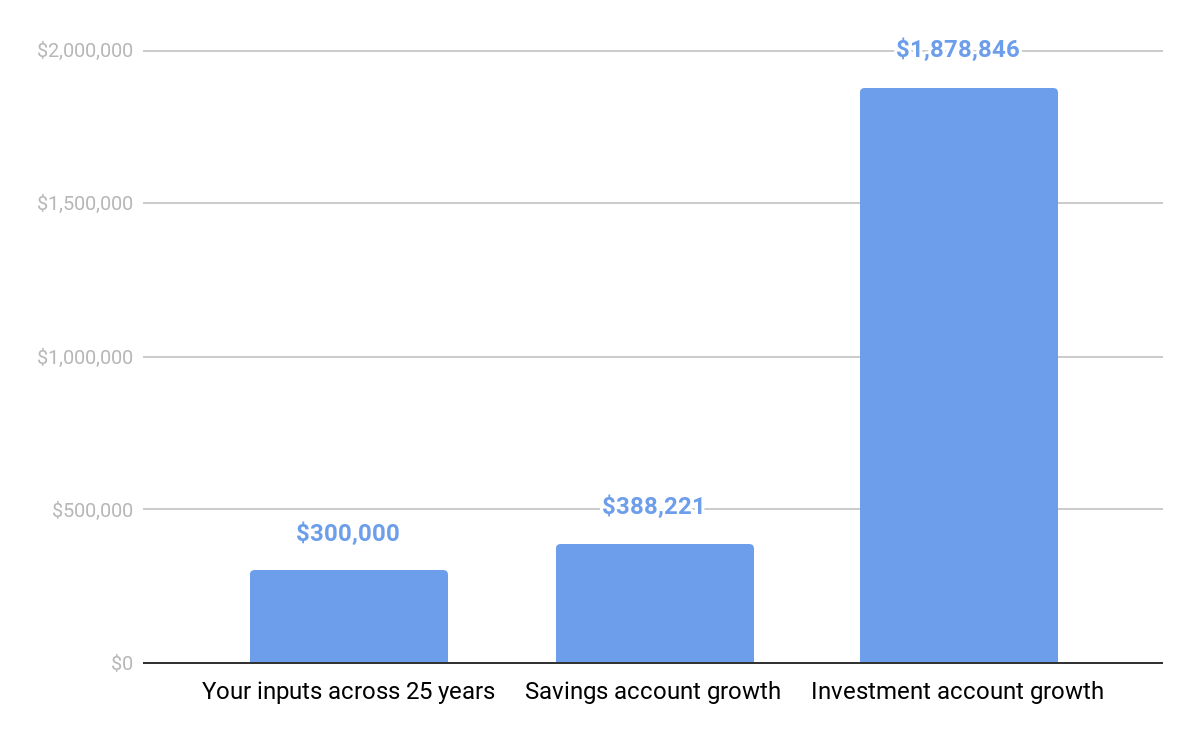

Now let’s compare how your money would grow depending on whether you saved it or invested it. Let’s assume that each month you put $1,000 into a savings account. Over 25 years, you would have consistently saved money to eventually end up with $300,000. But let’s not forget that your money has grown by 2% annually in this savings account. This means your savings have grown to $388,221 – not bad!

Now consider a different scenario – instead of saving your money, you have been putting $1,000 into an investment account each month for 25 years. Compound your inputs with a 12% annual growth and suddenly, you’re looking at a total of $1,878,846 in the same time period. Your money just grew by 600%!

I’m Sold! How Do I Begin Investing?

Employing a strategy that works for your growth goals and risk appetite is important. Attempting to predict market trends is futile and hunches are based in bias. This is where data can work for you! Understanding past data will not only pick the best investment strategy but also to avoid the worst strategies for you.

This is where shüts wealth comes into the picture. shüts wealth’s interactive platform aims to educate you and give you the tools to back-test strategies so that you can make the best decisions for your money. If you are looking to gain financial freedom and freedom from reliance on third-party analysts and institutions, you’re at the right place! Sign up today to get on our invitee list! Explore for yourself the power of compounding through our wealth estimator.